Tax Savings Opportunities

The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $45,000 or less (among other requirements). Property Tax Postponement

Exemptions

Homeowners’ Exemption

- Property owners may file an application for a Homeowners’ Exemption on a residence that is both owned and occupied as their principal place of residence as of 12:01 am on January 1. The exemption reduces the assessed value by $7,000 therefore, reducing the property tax bill. This translates to a savings of approximately $70.00 per year.

- Applications must be filed by 5 pm on February 15 following the change of ownership. If not filed timely, 80% of the full exemption is available if filed between February 16 and 5 pm on December 10.

- The application for Homeowners’ Exemption need only be filed once, provided the owner continues to occupy the property as the principal place of residence on which the exemption is filed.

- It is the property owners’ responsibility to apply for the exemption; it is also the property owners’ responsibility to terminate the exemption when no longer eligible.

- The property owner should notify the Assessor’s Office when any changes occur.

Disabled Veteran’s Exemption

- A veteran who owns and occupies a home as their principle place of residence and who is rated 100% disabled by the Veterans Administration due to a service connected disability (or the unmarried surviving spouse of such a veteran), may be eligible for an exemption up to $150,000 of the assessed value of their home.

- A veteran may qualify for either a Basic or Low Income Disabled Veteran Exemption.

- The Basic Exemption increases to the Low Income Exemption if your household income for last year did not exceed the annual income limit stated by the State Board of Equalization.

- The Basic Exemption need only be filed once, provided the owner continues to occupy the property as the principal place of residence on which the exemption is filed. Annual filing is required for any year in which a Low Income Exemption is claimed.

- It is the property owners’ responsibility to apply for the exemption; it is also the property owners’ responsibility to terminate the exemption when no longer eligible.

- The property owner should notify the Assessor’s Office when any changes occur.

Institutional Exemptions

- Real and personal property used exclusively by a church, non-profit college, cemetery, museum, school or library may qualify for an exemption.

- Properties owned and used exclusively by nonprofit religious, charitable, scientific, or hospital corporations may qualify for a Welfare Exemption.

- Applications for exemptions are due by February 15.

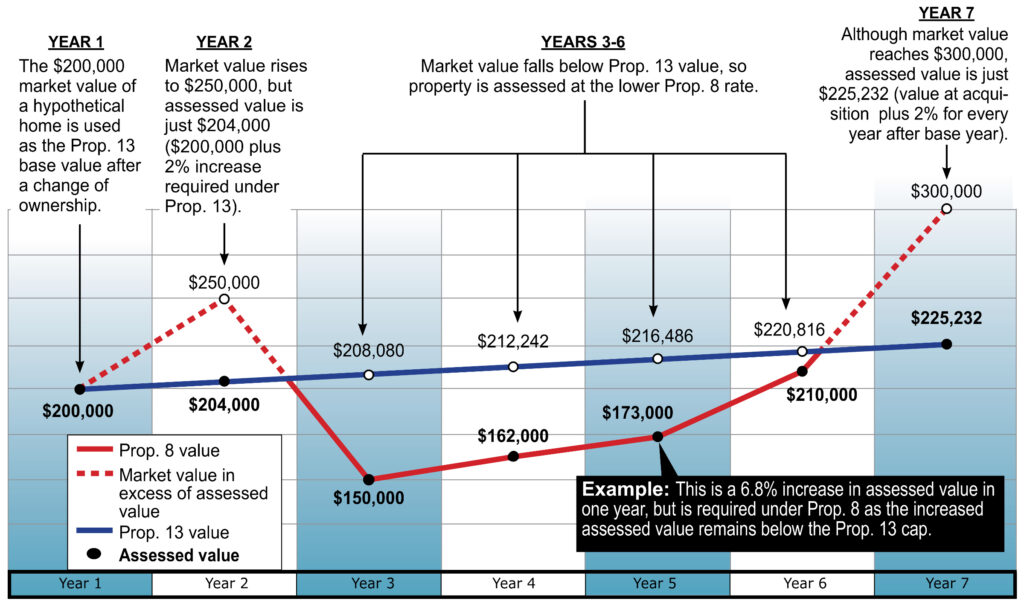

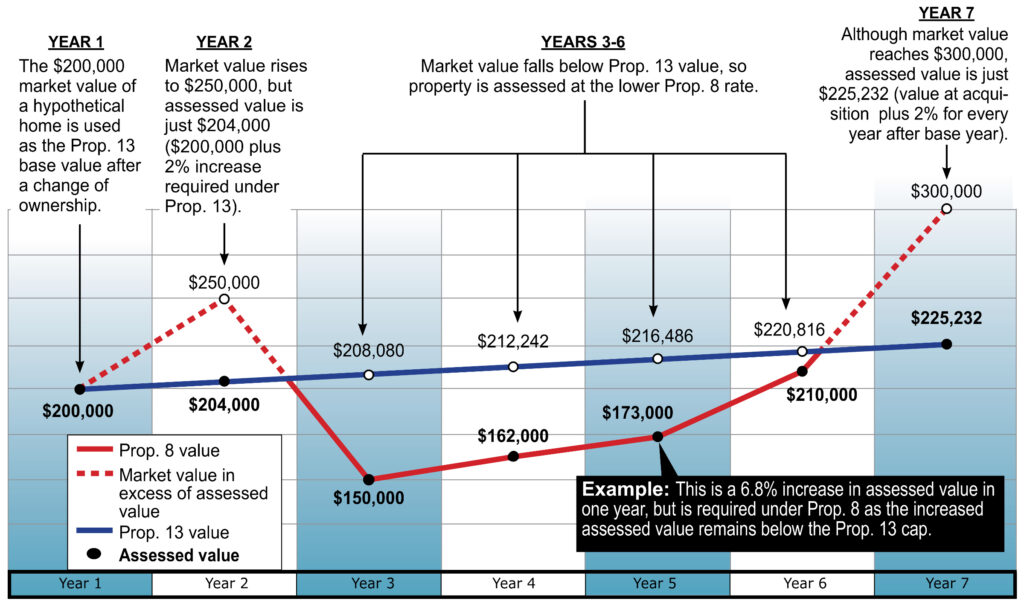

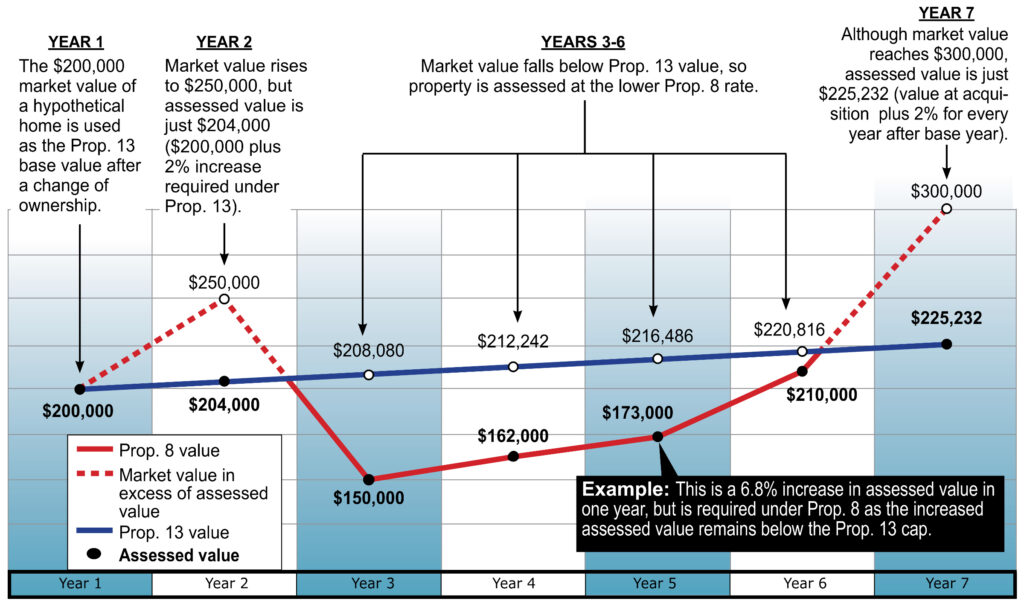

Proposition 8 – Decline in Market Value

This proposition allows the Assessor to temporarily lower assessments when the market value on January 1 is lower than the factored base year value for that year.

- If you feel your property has suffered a decline in value; that is, the current market (saleable) value of your property has fallen below the current assessed value as shown on the assessment roll, you may request a “Prop 8” decline in value “free” reassessment by the County Assessor.

- Upon written application by the property owner to the Assessor’s Office the property value will be reviewed as of the preceding January 1st lien date. The last day to file an application for the preceding January 1st lien date is December 31st.

- If the market value of the property is less than its factored base year value, market value will be enrolled for that specific assessment year.

- Whenever such relief is provided, the Assessor is obligated to annually review and enroll the lesser of either market value or the factored base year value, but never higher than the factored base year (Proposition 13) value.

- Call, write or visit the Assessor’s district office for more information

If it is determined that the current market value of the property exceeds the factored base year value, the factored base year value will be fully restored for the assessment year. When the factored base year value is restored, the property will no longer require an annual review and will then be subject to assessment under Prop 13 provisions. The application for “decline in value” reassessment (Prop 8)

Chart Description

- Initial base year value: In year 1, the subject property was purchased (transferred) for $200,000 and the Assessor enrolled that amount as the base year value.

- Year 2: The market value of the property has grown to $250,000. The maximum amount the property could be assessed under proposition 13 is $204,000 ($200,000 + 2%).

- Years 3-6: The market value of the property has decreased below the factored base year value (prop 13) limit. The assessment, upon request of the property owner, would be reduced to the actual market value.

- Year 7: Although market value reaches $300,000, assessed value is just $225,232 (value at acquisition plus 2% for every year after base year).

Exclusions

Base Year Value Transfer Exclusion (Propositions 60/90/110)

- Senior citizens 55 years of age (in the case of married couples, only one spouse must be 55 years or older) can buy a residence and transfer their current assessed value to the new home if the new residence is of equal or lesser market value. This prevents a tax increase due to reappraisal of the new home.

- Effective January 1, 2014 the San Bernardino County Board of Supervisors adopted an ordinance which now enables you to transfer the taxable value from your original property (Proposition 90) located outside of San Bernardino County to your new property when certain conditions are met.

- Other counties in California have passed ordinances enabling Proposition 90. We recommend that you contact the county to which you wish to move regarding Proposition 90 (inter-county transfers) eligibility within that county.

Parent to Child Exclusion (Proposition 58) / Grandparent to Grandchild Exclusion (Proposition 193)

- The transfer of the principal place of residence and /or the first $1,000,000 of other real property between parents and their children can be excluded from reassessment if a proper application is filed. This can also apply for grandparent to grandchild transfers provided that all of the parents of the grandchild are deceased as of the date of the purchase or transfer.

Spousal Exclusion

- The transfer of property between husband and wife does not result in a reappraisal for property tax purposes. This includes transfers resulting from divorce or death of the spouse. No form is required for this exclusion, but proof of the spousal relationship may be required.

Government Acquired Property Exclusion

- Property owners that have property taken by government action or eminent domain proceedings may qualify for an exclusion from reappraisal by transferring their Prop-13 factored base year value of the government acquired property to a replacement property if an application is timely filed and all requirements are met.

- The replacement property must be purchased and an application form must be filed with the Assessor within 4 years from the date of acquisition.

- For claims filed after the 4 year deadline, retroactive relief is available – please contact the Assessor’s District Office for further details.

Builders Exclusion

- Completed new construction may be excluded from supplemental assessment under certain circumstances. The property must be intended for sale and the builder must file the necessary application with the Assessor’s Office prior to or within 30 days of the start of construction.

- If the application is filed and the exclusion is approved, the new construction is appraised as of the date completed and enrolled for the following lien date. The builder will not get a supplemental assessment unless the property is occupied or used, with their consent, for purposes that are not incidental to the sale of the property. If the builder allows occupancy or use for purposes other than marketing the property, the supplemental assessment would be based on the date occupied or used rather than the date it was actually completed.

- If the application is not filed or the exclusion is not approved, a supplemental assessment is made to the builder upon the completion of construction.

Disaster Relief

- If a major calamity such as a fire or flood damages your property, you may be eligible for property tax relief.

CA State Board of Equalization Taxpayer Advocate – Tax Savings Information Sheets

- Further details regarding tax savings opportunities is available at https://boe.ca.gov/tra/infosheets.htm.