Picture this: you run a homeless shelter, and you’re always coming up with innovative ways to fundraise so you can provide your residents with everything they need, including food, clothing, blankets, and personal care items.

While it’s important for your organization to solicit monetary donations and maintain a regular flow of cash, you could also benefit from in-kind donations. Receiving some items directly from your donors reduces the need for your organization to procure them, freeing up time and resources for other initiatives.

To jumpstart your in-kind donation collection efforts, we’ll review everything you need to know, including:

Once you understand exactly what an in-kind donation is, its benefits, and how to best solicit, record, and report on them, you’ll be all set to start collecting these contributions for your beneficiaries.

An in-kind donation is a nonfinancial donation, typically of goods or services. In-kind donations allow nonprofits to access goods and services that they may not be able to afford to purchase.

As a result, they can free up resources they’d typically spend on those items and reallocate them to other areas of their budget. For example, let’s say an animal shelter typically spends $500 per week on pet food. If donors contribute in-kind donations that total a month’s worth of pet food, then the shelter would have $2,000 of extra funds that they could spend on other expenses.

This opportunity also encourages businesses to contribute to nonprofits since they may be more willing to contribute items than cash. Consequently, businesses and nonprofits can forge impactful partnerships that push both of their goals forward.

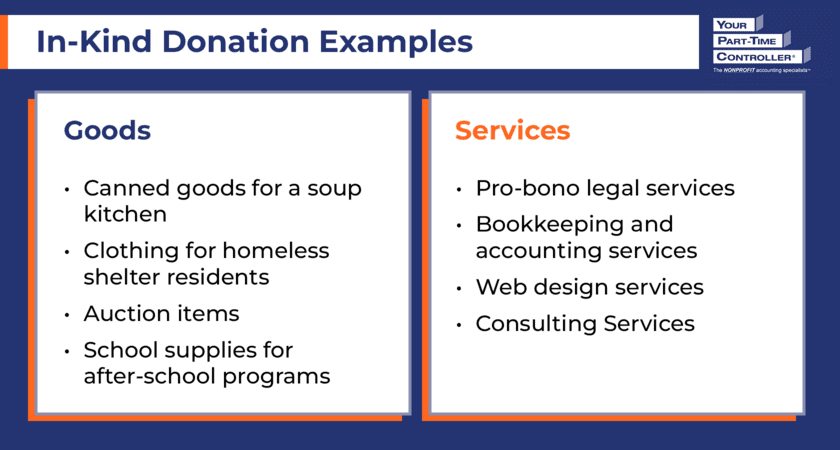

There are two main types of in-kind donations: goods and services. We’ll review what each type entails and give a few examples.

When you picture an in-kind donation, you’re most likely thinking of a contribution of goods. Goods are donated materials or assets (usually physical items) that your nonprofit can benefit from. Common examples of goods nonprofits may receive include:

Organizations can either use these assets in their programs or sell them for cash to fund their activities.

It’s possible that instead of an item, a donor contributes their time or expertise to your nonprofit. That way, your nonprofit doesn’t have to pay for this service as they normally would, which can be especially helpful for new nonprofits or organizations on a tight budget. Services an individual or organization may donate include:

While mid-sized to larger nonprofits may outsource these services, smaller nonprofits may seek out community members willing to donate their time and expertise until they have the resources to pay professionals.

In addition to goods and services, your nonprofit might also receive in-kind donations of:

For instance, it’s common for nonprofits to receive free use of office space as an in-kind donation.

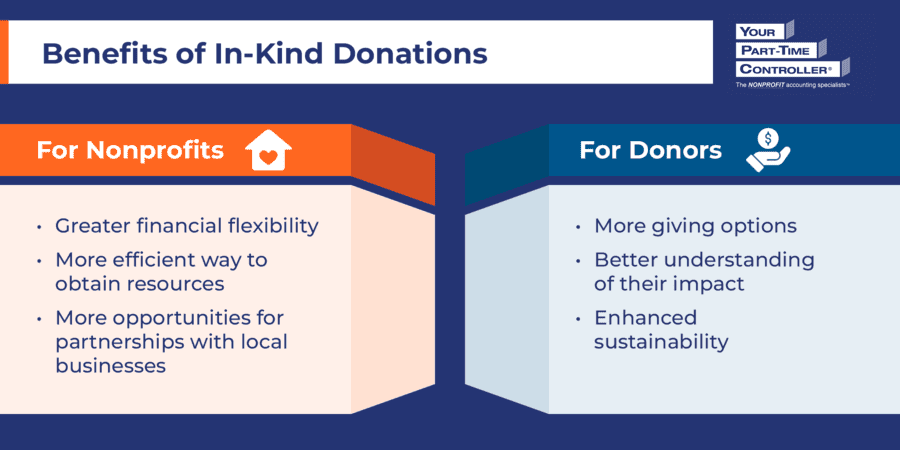

When your nonprofit secures in-kind donations, you receive greater benefits beyond the items themselves. These benefits include:

Additionally, in-kind donations benefit the donors who contribute them. These advantages include:

While monetary donations are always useful for nonprofits, in-kind donations diversify the support you receive, allowing you to reduce your reliance on cash donations and provide unique opportunities for donors to contribute.

The largest challenge of accepting in-kind donations is that sometimes nonprofits receive items they can’t use. These may include expired items, broken or damaged goods, items with legal restrictions, or hazardous materials.

To combat this issue, your nonprofit should create a comprehensive gift acceptance policy and ensure donors know where they can reference it. This policy should include:

These types of policies not only help donors determine whether their gift will be accepted, but they also allow nonprofits to politely decline gifts by referencing the policy. It’s much easier (and kinder) to tell your donors, “Thank you so much for your contribution. Unfortunately, this donation violates our gift acceptance policy, so we regretfully won’t be able to accept it,” than to simply turn them away.

Additionally, promoting your gift acceptance policy can inspire donors who have eligible items on hand to contribute. For instance, a soup kitchen may create a social media post highlighting items that are currently in demand and attach its in-kind donation policy. Upon seeing the post, a donor may go through their pantry to find non-expired canned goods and drop them off at the soup kitchen’s headquarters the next day.

Once you receive in-kind donations, you’ll have to record them in your accounting system and report them for tax purposes. According to Generally Accepted Accounting Principles (GAAP), nonprofits must keep thorough records of all monetary and in-kind donations. These records will also help prepare your organization for future financial audits.

However, an in-kind donation must meet specific requirements for recognition within its financial reports. For example, donations of services are recognized if they create or enhance nonfinancial assets (such as a group of parents getting together to build a storage garage behind a nonprofit’s office) or are provided by individuals possessing specialized skills (such as professionals and craftsmen) and would typically need to be purchased if not donated. Thus, while valuable to helping a soup kitchen meet its mission, the services of volunteers who work the food line for Thanksgiving dinner would not meet the requirements for recognition in the entity’s financial reports, for example.

It’s required that nonprofits report in-kind donations separately within their financial statements. This means you should record in-kind donations in a separate revenue account within your chart of accounts.

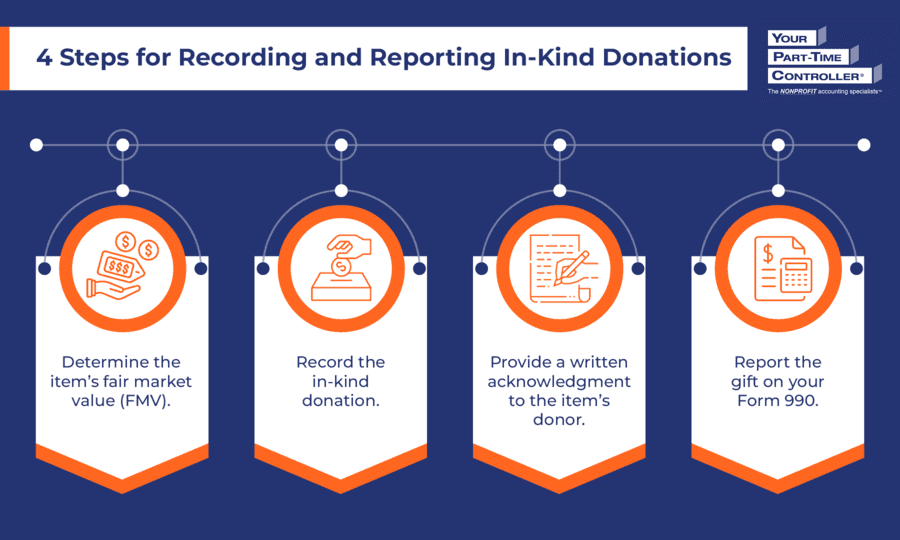

After determining whether an in-kind donation meets the requirements for recognition, follow these steps to properly record and report the contribution:

Fair market value (FMV) refers to the price you would typically pay for a good or service on the open market. You should record gifts-in-kind at their fair market value when you receive them. For auctions, record donated auction items at fair value when you receive the gifts, and adjust the value up or down based on the amount received when sold at auction.

Depending on the item you’re evaluating, there are several different ways to determine FMV:

As mentioned above, you’ll record your in-kind donation in a separate revenue account within your chart of accounts. In general, in-kind donations will have no impact on your entity’s net income because you’ll record the value of the donation as both a revenue and expense item.

For instance, let’s say that your organization has received $500 worth of pro bono legal services from a local attorney. Your entity would recognize both revenue and expense for the legal services contributed.

In-kind donations of property are typically tax deductible, but the IRS will not allow taxpayers to deduct contributions of $250 or more unless they obtain a written acknowledgment from the recipient charitable organization. It’s important to note that the IRS does not allow taxpayers to deduct the value of time or services.

The written acknowledgment should include:

For a more in-depth overview of acknowledgment requirements, refer to Publication 1771, Charitable Contributions: Substantiation and Disclosure Requirements from the IRS.

Legally, your nonprofit can’t provide the value of the donation to the donor—they’ll need to fill that in themselves when they prepare their tax returns. However, you can (and should) assure them of the impact of their contribution and show your appreciation for their gift.

Form 990 annual information returns require nonprofits to report all noncash contributions as part of their total revenue for the year. While you’ll report donations of property and goods, gifts of services and use of facilities are not included in the revenue section but are reported as a reconciling item at the end of the form.

Additionally, there are a few types of in-kind donations the IRS requires additional paperwork for, including:

There may also be additional reporting requirements depending on your state of operation, so be sure to check for relevant guidelines so your nonprofit can maintain compliance.

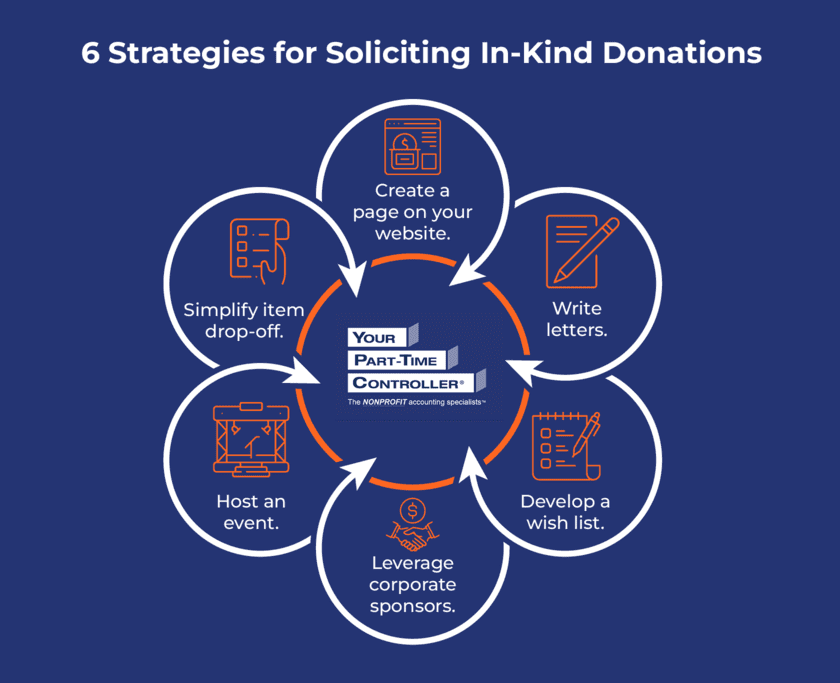

Now that you’re prepared to record and report in-kind donations, it’s time to begin soliciting them! To help you get started, we’ve compiled several strategies for encouraging and collecting in-kind contributions:

The more clearly you communicate to donors which items you need and how to drop them off, the more likely you are to receive useful, eligible contributions in a timely manner.

With an in-depth understanding of in-kind donations and how they can help your organization, you’ve likely already started thinking about which items your nonprofit could most benefit from. Finalize this list with your team, and promote it to your supporters, along with your gift acceptance policy.

While we’ve reviewed how your organization can properly record and report your in-kind donations, take the stress out of this process by leaving it up to professionals. The nonprofit accountants at YPTC are equipped to assist you with your in-kind donation recording and reporting needs.

For more information about nonprofit financial management, check out the following resources: