For many years, there have been standard valuation practices for multi-let office buildings where different tenants are occupying different floors in the same building. A recent case has brought about changes to how multi-occupied buildings are likely to be valued. We summarise in this article the rules that have previously applied and potential changes brought about by this case that affected businesses need to know.

The general rules have applied as follows

Consecutive floors occupied by the same tenant have been valued as a single assessment

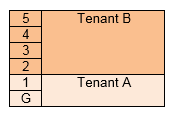

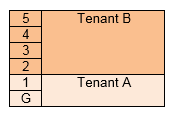

For example, in an office block where Tenant A occupies the Ground and 1st floors and Tenant B occupies the 2 nd to 5th floors.

This would result in two rate bills, one for Tenant A one for Tenant B. Quantum discounts may be applicable for both tenants.

Non-consecutive floors, separated by different tenants have had their floors rated separately

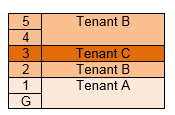

For example, in an office block where Tenant A occupies the Ground and 1 st floors, Tenant B occupies the 2 nd , 4 th and 5 th floors and Tenant C occupies floor C (in between Tenant B’s floors).

This would result in four rate bills, one for Tenant A, two bills for Tenant B and one for Tenant C. Tenant A might receive a quantum allowance and Tenant B might receive an allowance for the 4 th and 5 th floor assessment. The second and third floor assessments are unlikely to receive a discount.

Changes in the law

Earlier in the year, a long-running case Woolway v Mazars was heard by the Supreme Court. The issue was whether (using the second example above) Tenant B should have a single assessment for all three floors even though his occupation is ‘interrupted’ by another tenant.

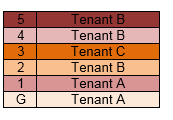

The Supreme Court ruled it should not be a single assessment but in doing so threw out some long-standing case law and decided that, in multi-occupied buildings where the tenant does not control common parts, an assessment should be made individually for each floor, regardless of consecutive occupation:

This would leave six separate assessments, none of which are likely to qualify for a quantum reduction. Tenant B would receive three separate rate bills and Tenant A would now receive two.

What does this mean?

Unless any primary legislation is enacted, this means that multi-occupied buildings may be valued differently.

The practical changes we may see are as follows.

One effect of a change to a rates assessment could be a loss of quantum discount and therefore an increased rate bill. This can currently be backdated to 1 April 2010.

In terms of preparing for any changes, PwC can help by reviewing current assessments and assessing the risk of an increase. If an appeal is ongoing, we can advise on likely outcomes for the outstanding appeal.

For further information

Please contact your usual PwC advisor or Philip Vernon to discuss how these changes might affect you.