By CNBC-TV18 August 29, 2023, 1:31:02 PM IST (Updated)

5 Min ReadReliance Industries Limited (RIL) stock is poised to provide a compounding return of 15 percent or more, a notably attractive rate in harmony with the broader expansion of earnings. This prospect is likely to draw the interest of reputable institutional investors and dedicated high-net-worth individuals.

In an interview with CNBC-TV18, Harshvardhan Dole, who holds the position of VP-Institutional Equities at IIFL, said a day after Chairman Mukesh Ambani's speech at the company's 46th annual general meeting.

Dole said that RIL has witnessed a gradual decline in its beta over the past 25 years. This shift can be ascribed to the increasing prevalence of businesses with lower volatility, particularly those geared towards consumer markets. With these ventures forming a larger segment of the company's capital and EBITDA, the turbulence in cash flow has considerably decreased. As a result, it's imperative for investors to understand that in the short to medium term, RIL might not outperform the market. However, this situation holds advantages for investors with a prolonged investment perspective.

“Having that in my mind, RIL stock will continue to offer 15 percent plus compounding, which is a very good handsome rate of return in sync with the overall earnings growth and that should attract any good institutional investor as well as serious high-net-worth individuals (HNIs),” he said.

Reliance Industries held its latest AGM (annual general meeting) on August 28, where Chairman Mukesh Ambani and other board members shared the company’s achievements and future plans. Reliance's commitment to concentrating on sectors with substantial growth potential remains unwavering. This encompasses areas like clean energy, data services, and fulfilling the comprehensive consumption requirements of the average Indian population.

Here are some of the key highlights from the AGM:

1. Mukesh Ambani is set to continue his role as the chairman and managing director of the company for the next five years. His three children, namely Isha, Akash, and Anant, will take up positions as non-executive directors on the RIL board. Additionally, Nita Ambani will step down from her position on the RIL board of directors, while retaining her position as the chairperson of the Reliance Foundation.

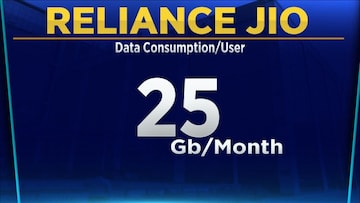

2. On the occasion of Ganesh Chaturthi, which falls on September 19th, Reliance Jio will launch JioAirFiber, which represents an advanced 5G hotspot tool capable of delivering ultra-fast speeds akin to fiber optics within homes or workplaces. This will help eliminating the need for physical wiring. With the capacity to facilitate 150,000 daily connections, the device surpasses traditional broadband connections using physical fiber tenfold.

In the context of Jio, Dole mentioned that we haven't factored in any rise in the average revenue per user (ARPU) for FY24. Looking ahead to FY25, our aspiration is for the ARPU to experience a growth of approximately 12-15 percent.

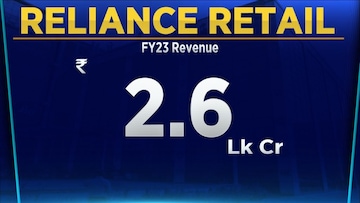

3. The valuation of Reliance Industries' retail business doubled from Rs 4.28 lakh crore in September 2020 to Rs 8.28 lakh crore at present, chairman Mukesh Ambani said on Monday, adding that it is the only Indian retail in the global top 100.

Dole stated that Retail's performance has consistently exceeded expectations. Regarding its expansion, IIFL is factoring in a 20 percent compounded annual growth rate (CAGR) for sales. Moreover, we anticipate that operational efficiency will begin to take effect from this point onward, given that the majority of recently added stores are nearing maturity within the next 3-6 months. As a result, FY25 is projected to mark a turning point for the retail segment. Consequently, we expect the growth in earnings before interest, taxes, depreciation, and amortization (EBITDA) to surpass the growth in sales over the upcoming 3-5 years.

4. While discussing RIL's endeavours in green energy, the chairman of the conglomerate said; “We are well on our way to building the New Energy ecosystem of manufacturing solar, wind, batteries, hydrogen, and bio-energy platforms.”

Dole mentioned that unless Reliance achieves unexpected execution successes and commences selling and providing these services to external parties, a substantial addition to EBITDA appears improbable until FY25-26. Nevertheless, it's important to note that the stock will likely begin reflecting a considerable portion of the potential advantages when the initial phase of the solar photovoltaics (PV) project begins to roll out, possibly around FY24 -25.

5. Ambani revealed plans for the company to invest Rs 75,000 crore in establishing a novel energy manufacturing ecosystem. Concurrently, Jio Financial Services is gearing up to introduce life and general insurance products.

Dole further stated that looking ahead, the driving forces for growth will likely be retail, Jio, and Jio Financial Services (JFS). This leads to the logical expectation that the increase in market capitalisation over the next ten years should surpass the growth witnessed in the previous decade. Essentially, this is linked to the portion of high multiple businesses and the overall rise in EBITDA, which should positively influence the overall valuation standpoint.

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

For more details, watch the accompanying video